The Buy to Let Mortgage Guide

10 steps to success for the BTL investor

1. The UK Buy to Let Mortgage Market

According to Government national statistics in

March 2022 there were 25.2 million dwellings in England, of which 4.9 million (19.4%) were in the private rented sector (PRS) and 4.1 million (16.3%) were for social & affordable rental. While owner occupation represents most households, the PRS is an important component of UK housing stock, provided by around 2.74 million landlords.

In 2022, more than

211,000 buy-to-let (BTL) mortgages were approved by lenders, representing 13.6% of total mortgage lending for the year. The average value of a BTL property is just under £260,000 and buyers pay, on average, a 25% deposit.

There are over 300 mortgage providers, over 60 of which are BTL lenders offering thousands of products. The 5 largest BTL lenders (Lloyds, Nationwide BS, Barclays, Coventry BS & OSB Group) account for over half the market.

A key measure for BTL investors is rental yield. This indicator measures the return on investment from the rental income of a property. Gross rental yield is calculated as the percentage of annual rental income relative to the property’s value. For example, £15,000 rental income for a £250,000 property value is a gross yield of 6%. Allowing for, say, £5,000 of property costs the net rental yield reduces to 4%.

Gross rental yields differ across the UK and even by city and post code. According to Track Capital’s

BTL Yield Map, average yields in 2023 in England range from 3.65% to 4.72% with yields in Scotland and Wales being 5.7% and 4.68% respectively.

The

English Private Landlord Survey 2021 summarised some of the policy changes that have affected Britain’s landlords. These include tax changes for BTL landlords, changes to stamp duty land tax (SDLT), tightening lending criteria of BTL mortgage providers and planned reforms to the PRS.

2. Understanding BTL mortgages

A BTL mortgage differs from a consumer residential mortgage in two important ways.

- The fundamental difference is the BTL mortgage is designed for a property owner who does not live at the property concerned, nor does a family member.

- BTL mortgages are also unregulated mortgage transactions whereas consumer residential mortgages are regulated by the Financial Conduct Authority (FCA) and therefore come with additional consumer safeguards.

BTL mortgage lenders offer different types of mortgage product which are broadly categorised into:

- Standard: a single property: a flat, terraced, semi-detached or detached dwelling

- Specialist: a multi-unit property such as an HMO (house in multiple occupation) which is shared accommodation or MUFB (multi-unit freehold block) which are self-contained units. Both are usually segmented into small and large depending on the number of rooms or units in the respective property.

- Semi-commercial: a property attached to commercial premises (such as a flat above a charity shop). Some lenders have restrictions on the type of commercial property that is acceptable, and some will only lend on the value & rental income of the accommodation rather than the entire property. Some lenders do not accept semi-commercial applications.

- Commercial: a property used for business activities and the key criteria will be if the owner is also the business occupier or a landlord to another tenant. Many lenders do not offer commercial BTL mortgages.

Lenders also segment their BTL products into:

- Non-Portfolio v Portfolio applicants: Portfolio investors typically have 4 or more BTL properties.

- Rental type: AST (assured shorthold tenancy) rentals which are usually 6- or 12-month tenant agreements versus holiday/short term/AirBnb lets. Some BTL lenders will not lend against holiday lets.

- New applications v remortgages v switch (the latter being an existing customer refinancing with the same lender)

- Applicants buying in their own name v buying via a specialist purpose vehicle (SPV) Limited Company, not a trading business.BTL Operating Structure

3. BTL Operating Structure

There are two ways to structure a BTL property investment: purchase in your own name as an individual or purchase through a special purpose vehicle (SPV) limited company (Ltd Co). Both approaches have implications for obtaining a BTL mortgage and have different tax treatments, so it is important to seek specialist advice.

An SPV Ltd Co must not be a trading business. It is a registered limited company, established to operate in the real estate space, and must be incorporated with the following SIC (standard industrial classification) codes:

68100 – Buying & selling of own real estate

68201 – Renting & operating of housing association real estate

68209 – Other letting & operating of own or leased real estate

68320 – Management of real estate

Lenders may not offer BTL mortgages to Ltd Cos and may also have restrictions on the number of Directors and may require shareholders with more than 25% of the equity to be included in the application.

4. BTL Mortgage Repayment Options

Mortgage repayments are usually either interest-only or repayment (capital + interest) and the applicable interest rate is either fixed or variable with, normally, a 2-year or 5-year fixed term, although other fixed terms are available. The length of the mortgage itself could be from 10 to 30 years.

Key criteria to determine the affordability of a BTL mortgage are property value, rental income, property type & location, borrower status (is the investor buying as an individual or via a non-trading Limited Company) and the tax & credit status of the investor.

Each BTL mortgage provider publishes lending criteria to illustrate the type of property and borrower they will support. These criteria include the value, type & location of the property and the key ratio, loan to value (LTV) which is usually in the 50% to 75% range. The lender will also stress test the mortgage in line with its testing criteria to ensure that the cost of the product offered is within its guidelines given rental income and borrower status.

The combination of the above will influence the product(s) which may be available, the potential loan amount, the cost of the BTL mortgage and associated fees.

5. Loan Amount

BTL mortgages are calculated differently to consumer residential mortgages which focus on the earned, or self-employed, income of the applicant(s). BTL lenders take the following variables into account:

- Value of the BTL property

- Type of property (standard, semi-commercial, HMO/MUFB)

- Type of rental (AST versus holiday/short term lets)

- Rental income

- Borrower status (individual basic versus higher taxpayer v SPV Ltd Co)

- Portfolio debt and income, if relevant

Lenders publish their stress test rates and typically the interest coverage ratio (ICR) used is either 125% for SPV Ltd Cos and basic rate taxpayers or 145% for higher rate taxpayers.

Some lenders also allow “top slicing” which allows them to consider other sources of personal income when deciding whether to lend to a potential landlord. Top slicing is becoming more mainstream, but lenders often restrict its use to property purchases rather than remortgages. Top slicing can be a useful tool for the right landlord, but it should certainly not be seen as a mechanism for those whose finances are tightly stretched already.

Lenders may have several applicable BTL products with different LTVs, fixed terms, loan amounts, fees and monthly costs. Likely products need to be stress tested to determine the optimum product that delivers the best combination of loan amount, fee and monthly cost for the applicant.

6. What happens at the end of a BTL mortgage?

In short, the mortgage needs to be fully repaid. There are 3 possible scenarios.

- With a repayment BTL mortgage, all the original capital will have been repaid at the end of the full term, so the property is 100% owned by the landlord.

- With an interest only BTL mortgage, all the original capital has still to be repaid at the end of the full term. This will be done by either by the sale of the property or by the borrower providing additional funds, maybe via an insurance policy.

- In the interest-only scenario, the borrower may well have a fixed rate period. Let’s take an example of a £250,000, interest-only, BTL mortgage over a 15-year term with a 5-year fixed rate.

Towards the end of the fixed rate period the mortgage company will advise the borrower that the fixed term is nearing conclusion and that they will transition automatically to the reversion rate. The reversion rate is the standard variable rate that applies for the remaining 10 years of the mortgage term. It will have been clearly shown on the mortgage offer document and is usually described as X.X% + BBR (bank base rate). The borrower has the choice of continuing with the existing BTL mortgage at the reversion rate or re-financing to a new fixed term mortgage either with the same lender (a switch product) or a new lender.

In the event of a re-mortgage with a new lender the new mortgage will need to be sufficient to repay the first lender the £250,000 capital originally borrowed. In the UK we have become used to rising property prices and so there is an expectation that landlords will be able to re-finance easily. However, if property prices have fallen in the fixed period there is a risk that a new lender may not offer enough, and the borrower will need to make up the difference.

See below for implications of redeeming a BTL mortgage before the term ends.

7. Eligibility

Applying for a BTL mortgage is not as easy as getting a standard consumer residential mortgage. If you want to invest in property and become a landlord, but don’t have enough capital to buy a property outright, then you will need a BTL mortgage. There are certain criteria you must meet to be eligible.

Usually, you must already be a homeowner, either outright or with an existing mortgage. You will have more success if you have a good credit rating, and most lenders require BTL applicants to be earning at least £25,000 annually.

As a result, the minimum age for a BTL mortgage is 21 years and most lenders also specify an upper age limit, at the end of the mortgage term, usually 75-85 years old. This means for older landlords the mortgage term may need to be restricted to 10 years.

Lenders also have minimum (and maximum) limits on property values, loan amounts and portfolio values. They also have restrictions on acceptable types of property, construction methods and location. They may also have concentration restrictions which limit how many mortgages they will provide in a particular multi-unit property or development.

8. BTL Mortgage Application Process

A BTL mortgage process takes time and involves a lot of detailed information about the borrower and the property. It can be broadly divided into these stages:

Research and product selection

Finding the optimum BTL product that suits the characteristics of the property, the needs of the borrower and that fits the lender’s criteria. Although it is possible for the landlord to do the research personally it saves time and money to use a BTL mortgage intermediary or broker as they are likely to have systems to efficiently review products from all lenders.

Acceptance in Principle (AIP) (also called Offer in Principle or OIP)

Each lender typically has an initial enquiry process which requires submission of the key application criteria so that they can provide indicative terms which highlight the loan amount, interest rate, arrangement fee and any other costs. The information required at this early stage varies but typically it includes:

- Borrower details (full name, date of birth, home address, income, employment details

- Property details (full address, description, value, EPC rating, rental income)

- Property portfolio (details of the existing properties owned by the applicant)

- BTL mortgage product that applies or has been selected.

Should this be accepted by the applicant then a full mortgage application (FMA) may be initiated. The FMA normally requires a small lender application fee to be paid and many lenders also require the valuation fee is paid at the same time.

Full mortgage application

The FMA will involve providing additional details about the borrower, the property and the property portfolio. It will be necessary to provide evidence of these statements by uploading salary information or SA302s (self-employed tax returns), a statement of assets, liabilities, income and expenditure (often called SALIE) and a spreadsheet detailing the landlord’s existing property schedule.

Offer subject to valuation

Once the FMA is submitted there is usually a wait time while it joins the credit queue. Once assessed by the credit team there may be questions of clarification or requests for additional information. Once everything is reviewed an offer is made subject to an acceptable valuation. Some lenders have slightly different processes and instruct the valuation at the same time as reviewing the FMA.

Valuation process

The valuation is carried out by a professional surveyor, usually part of a panel of surveyors used by the lender. The cost is paid by the applicant and is paid when the surveyor is instructed by the lender. The applicant will have to arrange for access to the property. The valuation report is submitted directly to the lender, usually after a few days, and provides the lender with a detailed report on the property, comparable values of similar properties nearby and a valuation figure which becomes the basis of the lender’s final offer. There is always a risk that the valuation report does not agree with the applicant’s property value which results in a reduced loan amount being offered. It can, of course, go the other way.

Final offer

Once the valuation report is received the lender will send the applicant a final offer which usually has a 30-day acceptance limit. This offer is now credit-backed and supported by a valuation report. If the applicant accepts the offer the solicitor is instructed and legal documents are drafted.

Completion

The final part of the process is the legal documentation. The applicant has the choice of instructing their own solicitor or dual representation. To instruct their own solicitor they either select a firm from the lender’s approved solicitor panel or use their own firm which normally must have at least two partners and be registered with the relevant law society.

Dual representation means the lender’s solicitor acts for the borrower and the lender.

The legal process will include land registry searches, drafting the mortgage agreement, charges against the property and any KYC/AML requirements.

KYC (know your client) involves provision of the borrower’s identity documents and proof of address.

AML (anti money laundering) provisions require that the borrower demonstrates that funds being provided as deposit are legitimately sourced.

Once the legal process is concluded the funds are drawn down and the mortgage becomes a legal obligation for the borrower with the property secured in favour of the lender.

9. Understanding BTL Mortgage Costs

There are various fees involved in obtaining a BTL mortgage which differ from lender to lender but broadly include the following:

- Application fee: a modest fee to accompany the application which is usually non-refundable.

- Valuation fee: the cost of instructing a qualified surveyor to prepare a detailed report on the property. The cost varies according to the property value and is sometime paid at the same time as the application fee.

- Legal fees: the cost of instructing your solicitor and the lender’s solicitor to complete the relevant loan documents, property searches and charges. Most lenders have tiered fees relating to the value of the mortgage and if the borrower is an individual or SPV Ltd Company.

- Arrangement fee: this fee is also known as the “product fee” and will vary from product to product within a lender. It can be quite a large amount. It is usually deducted from the gross loan to derive the net loan amount that the borrower receives. Arrangement fees can be zero but also as high as 7% of the mortgage amount required. Paying a higher arrangement fee can often lead to a higher loan amount and/or a lower monthly mortgage cost. However, the gross amount needs to be repaid at the end of the mortgage or when being re-financed.

- Redemption fees: An early repayment charge (ERC) is a fee you might have to pay your lender if you want to end your BTL mortgage before the fixed rate period or full-term ends. They don’t usually apply if you are paying the lender’s standard variable rate (SVR) or a tracker mortgage and want to switch away. ERCs are not a cost of obtaining a BTL mortgage, but need to be considered if the borrower thinks he may wish to redeem the mortgage earlier. ERCs are expressed as a % of the outstanding mortgage amount annually. For a 5-year, fixed term, interest only BTL mortgage the ERCs might be 5%, 4%, 3% ,2%, 1%. So, for a £200,000 BTL mortgage, if you redeem in Year 2 the ERC would be £8,000 but if redeemed in Year 5 it would be £2,000.

- Funds transfer fee: a small amount to cover the cost of electronic funds transfer at the completion of the BTL mortgage process.

10. Understanding BTL Landlord Costs

When you become a BTL landlord there are many costs involved in addition to the monthly mortgage payment. You should budget for these when considering taking out a buy-to-let mortgage.

Letting Agent Fees

If you use a letting agent or estate agent to manage your property, you will have to pay them letting agent fees. Their services will vary, but can include carrying out credit checks on tenants, writing contracts and chasing unpaid rent. They can also pay towards health and safety checks on your property, which you must do to ensure the home is safe and up to living standards. Online sites such as www.compareagentfees.com will enable you to research the local market to find the agents to suit your needs and compare fees.

Landlord Insurance

Landlords have a legal responsibility to supply a safe property, especially relating to electrical and gas equipment. Fortunately, many accidents can be prevented by carrying out regular maintenance and repairs. BTL landlord insurance provides cover for the rental property, its contents and landlord liability.

Liability insurance protects landlords from potential compensation claims related to the rental property, for example if someone injures themselves or other property is damaged because of your property. It pays any compensation and resulting legal fees to a third party such as a tenant, visitor or a tradesperson in the event of a claim.

Operating Licence – HMOs

You don’t require a licence to rent a standard residential BTL property but if the property is an HMO, a multi-unit property with shared facilities, with 3 or more tenants who form 2 or more households, you

may need to apply for an HMO licence from your local authority.

For large HMOs with shared facilities in England & Wales, rented to 5 or more people who form more than 1 household, you

must have an HMO licence.

BTL mortgages for HMOs are typically only available from specialist mortgage providers and are more expensive than standard BTL mortgages.

Maintenance

As a residential BTL property owner you are responsible for any repairs or building costs, not your tenants. This includes fixing any problems with the heating or water supply, or any existing appliances that break down naturally. These costs may be intermittent but can add up over time. You are also responsible for ensuring electrical appliances and gas equipment are serviced and certified. Finally, you may need to upgrade your property to enable it to have a suitable Energy Performance Certificate (EPC). Currently only BTL properties with EPC rating of A to E may be rented. This is likely to change to A to C in 2025.

See our EPC Guide here.

Missed / Late Payment & Rental Voids

Tenants may experience financial difficulties and be unable to pay the rent, and they also move on to other properties. Landlords need to factor in gaps in the rental income. During those periods the mortgage payment still needs to be paid and missed mortgage payments could result in the repossession of your property.

Income Tax

Tax is a specialist subject and a BTL landlord should take advice on the most tax efficient way of structuring their rental property.

If you own the BTL property in your own name any monies received from tenants are deemed to be income and must be declared. You can deduct allowable expenses and the total mortgage interest payment will qualify for 20% tax relief. Allowable expenses include council tax, utility costs, landlord insurance, costs of services, letting agents’ fees, certain legal fees, accountant’s fees, ground rents, service charges and direct marketing costs.

Rental profits are taxed at the same rates as the income you receive, or would receive, if you have additional employment, currently 0%, 20%, 40% or 45%, depending on which tax band the income falls into. Remember that your rental activity may tip you into a higher tax bracket.

Corporation Tax

If you operate your BTL via an SPV limited company the rental income and all costs associated with the property will form part of the business accounts. If successful, the landlord will be able to reinvest profits, draw a salary or pay dividends, or a combination. The SPV will pay corporation tax on eligible company profits, currently at 19%, or 25% if profits are above £250,000.

Capital Gains Tax (CGT)

Homeowners who sell their primary residence do not pay CTG as they receive private residence relief. However, this does not apply to BTL properties as they are not a primary residence. CGT will therefore apply if you sell your BTL property for a profit.

Broadly speaking, after considering annual exemptions, basic-rate taxpayers pay 18% on gains they make when selling residential BTL property, while higher rate taxpayers pay 28%. Commercial BTL property gains are taxed at 10% and 20% for basic and higher rate taxpayers respectively.

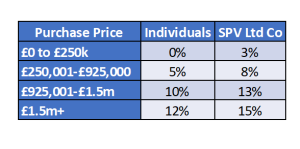

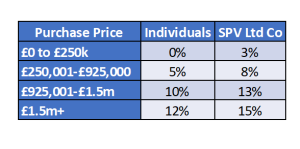

Stamp Duty Land Tax (SDLT)

SDLT is a tax paid on the purchase of property or land, in addition to the purchase price. Rates differ for purchases by individuals versus those by SPV limited companies and are currently as follows:

SDLT Rates 2023:

Conclusion

Becoming a first time BTL landlord is a major step, yet, according to

The English Private Landlord Survey 2021, referenced earlier, the majority of landlords own multiple properties.

- 43% own one rental property

- 39% own 2 to 4 rental properties

- 18% own five or more rental properties

The two obvious benefits of being a BTL landlord are earning rental income and generating capital growth. Both are balanced by the two main risks of income shortfall, due to tenant voids and missed payments, and a decline in property values.

Being a successful BTL landlord is complex and involves getting a lot of things right over the long term. Ensuring that you obtain a BTL mortgage that meets your needs as a landlord and property investor is an important first step. We hope that this BTL Mortgage Guide will help you take the next step on your landlord journey.

Why use Blueray Capital?

With thousands of BTL mortgage products available from over 70 BTL lenders there are good reasons to use a specialist BTL mortgage broker, such as Blueray Capital, to help you achieve your goals:

- We have state of the art mortgage systems which give us immediate access to all BTL mortgage lenders and the thousands of products they offer. In recent times lenders have been changing their products frequently, so without these systems it would be very difficult to keep up with the market.

- We have good relationships with all the BTL mortgage lenders. We know their lending criteria and application process requirements and can provide a prompt response to you on their appetite and indicative terms.

- We make the process easier for you by communicating clearly, summarising mortgage finance options so that you can make informed decisions, clarifying information requirements and ensuring the application is submitted correctly. We’re with you from start to finish.

- In addition to BTL mortgages we also provide a complete range of property finance solutions: bridging finance, refurbishment and development finance and portfolio re-finance.

If we can help you on your Buy to Let investor journey we would love to hear from you.

Email: enquiries@blueraycapital.co.uk